TL;DR: GetMyInvoices at a Glance

GetMyInvoices automates the collection of invoices from over 10,000 portals and syncs them directly with your accounting software (e.g., DATEV, QuickBooks, Xero). Thanks to AI-powered OCR and automatic bank reconciliation, you can save up to 20 hours of manual work every month. It’s the ultimate solution for e-commerce brands dealing with numerous international SaaS tools and marketplaces. If you need to be ready for the 2026 e-invoicing mandates, this is the hub you need.

We’ve all been there: It’s Monday morning, and instead of focusing on growth, you’re logging into Amazon, Google Ads, Meta, DHL, and Shopify just to download PDF invoices for your accountant. This “manual portal hopping” isn’t just soul-crushing; it’s a massive drain on your time—time that should be spent scaling your brand. Missing even one receipt could mean losing hard-earned money due to unclaimed tax deductions.

GetMyInvoices aims to kill this chaos for good. Acting as a central document management hub, the software automatically fetches all your invoices and pushes them straight into your accounting workflow. We took a deep dive to see if it really lives up to the hype, especially with the strict new e-invoicing regulations coming in 2025.

Stop Hunting for Invoices Manually

Automate your bookkeeping today and test GetMyInvoices with zero obligations.

The Sourcing Machine: Handling 10,000+ Portals

The standout feature of GetMyInvoices is its sheer connectivity. With access to over 10,000 online portals worldwide, there’s virtually no service provider the software doesn’t know. Whether it’s niche logistics portals or international SaaS providers, GetMyInvoices’ bots log in on a schedule and pull the latest documents for you.

A real lifesaver is how the tool handles Two-Factor Authentication (2FA). While many competitors break when faced with 2FA, GetMyInvoices can automate the process through authenticator app integrations. Once set up, you rarely have to lift a finger again.

💡 Pro-Tip: In the Amazon FBA world, marketplace invoices from third-party sellers are often a nightmare. GetMyInvoices can actually proactively request missing invoices from Amazon sellers if they aren’t provided automatically—saving your tax deductions from disappearing into the void.

GetMyInvoices vs. Invoicefetcher: Which One Wins?

When looking for invoice automation, Invoicefetcher is the other big name often mentioned. Both have their place, but they serve different philosophies:

| Feature | GetMyInvoices | Invoicefetcher |

|---|---|---|

| Portal Count | 10,000+ (Global Scope) | Focused Selection (DACH Focus) |

| Bank Reconciliation | Yes (Auto-match receipts to payments) | No |

| Mobile App | Native Scan-App included | Web-optimized only |

| Pricing | Starts at approx. €18 / month | Starts at approx. €4.59 (Cheaper entry) |

The Verdict: Choose Invoicefetcher if you are on a tiny budget and only need to fetch 5-10 standard German portals (e.g., Vodafone, Telekom). Go with GetMyInvoices if you need global coverage, bank matching, and a professional mobile scanning solution.

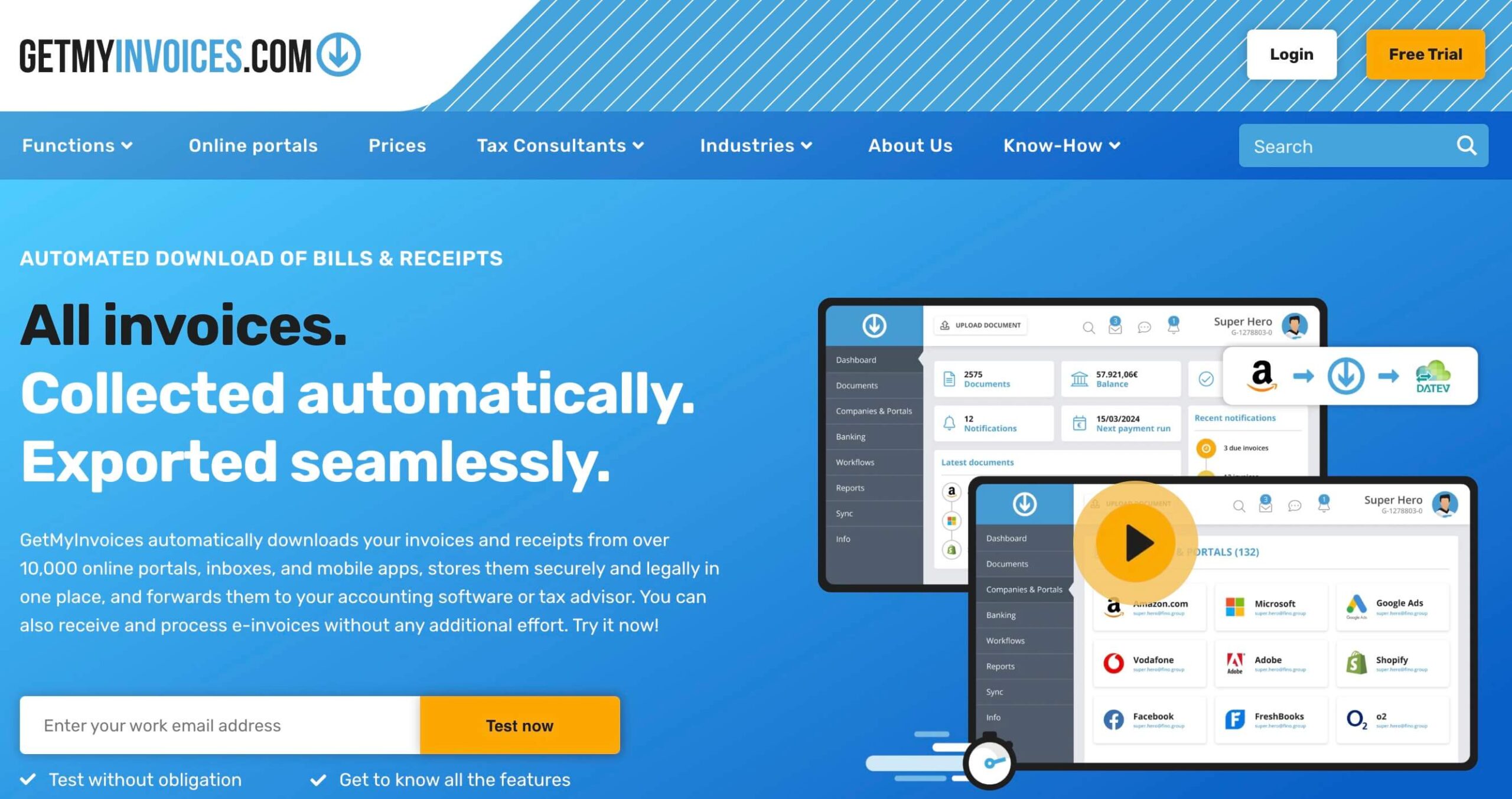

GetMyInvoices in Action: Dashboard Preview

The setup is intuitive, though the vast number of features can seem overwhelming at first. This video overview shows exactly how easy it is to link your first portals:

Future-Proof: E-Invoicing and Tax Compliance

Starting January 1st, 2025, structured e-invoicing becomes mandatory for B2B transactions in many EU regions (like Germany). Plain PDFs will no longer cut it—formats like XRechnung and ZUGFeRD are becoming the new standard. GetMyInvoices is already fully prepared. Its AI reads XML data directly, which reduces errors to near zero compared to traditional image-based OCR.

Furthermore, the tool supports strict compliance standards (like GoBD). By using “replacement scanning,” you can legally destroy paper receipts after digitizing them (as long as you have the proper process documentation). This doesn’t just save time; it saves physical storage space.

💡 Pro-Tip: Pair GetMyInvoices with your Amex Business Platinum. The tool automatically matches your credit card transactions with the fetched receipts. You’ll see instantly which invoice is missing before your tax advisor even has to ask.

Final Verdict: Essential for Scaling E-Com Brands

GetMyInvoices is far more than just a downloader. It’s the glue between your operations and your accounting. If you process more than 20 invoices a month, the tool pays for itself within days just by the time you save. Its massive portal range and readiness for the 2025 e-invoicing wave make it the best choice on the market today.